APPROVING THE RULES FOR THE ISSUANCE AND TRADING OF SECURITIES OF THE GOVERNMENT OF THE REPUBLIC OF LITHUANIA, TAKING LOANS ON BEHALF OF THE STATE AND SUBSCRIPTION FOR OTHER BINDING DEBT INSTRUMENTS

3 December 1997

Vilnius

Pursuant to Article 3(3) of the Law on State Debt of the Republic of Lithuania (Official Gazette, 1996, No 86-2045; 2010, No 145-7419) the Government of the Republic of Lithuania has resolved:

to approve the Rules for the issuance and trading of securities of the Government of the Republic of Lithuania, taking loans on behalf of the State and subscription for other binding debt instruments (as appended).

Prime Minister Andrius Kubilius

Minister of Finance Ingrida Šimonytė

APPROVED BY

Resolution No 1329 of the Government of the Republic of Lithuania of 3 December 1997 (as amended by Resolution No 1360 of the Government of the Republic of Lithuania of 14 November 2012)

RULES FOR THE ISSUANCE AND TRADING OF SECURITIES OF THE GOVERNMENT OF THE REPUBLIC OF LITHUANIA, TAKING LOANS ON BEHALF OF THE STATE AND SUBSCRIPTION FOR OTHER BINDING DEBT INSTRUMENTS

I. GENERAL PROVISIONS

1. The Rules for the issuance and trading of securities of the Government of the Republic of Lithuania, taking loans on behalf of the State and subscription for other binding debt instruments (hereinafter referred to as "the Rules") govern:

1.1. organisation of the primary and secondary trading of the securities issued by the Government of the Republic of Lithuania (hereinafter referred to as "the Government") (hereinafter referred to as "GS");

2. Definitions for the purposes of the Rules:

Settlement of GS shall mean the completion of a sale transaction on the primary and/or secondary securities market whereby the seller receives funds for the securities purchased by the buyer.

Provider of financial services shall mean a loan provider, an authorised intermediary of public securities trading, a person authorised by the GS issuer, GS auctioneer, fiscal agent, payment agent, creditor under other binding debt instruments or provider of financial services under other instruments related to Government borrowing on behalf of the State or other financial services.

Fiscal agent shall mean a Lithuanian or foreign bank with which the GS issuer has signed a contract on the organisation of settlement of the GS or other binding debt instruments.

Authorised intermediary of public securities trading shall mean an intermediary of public securities trading that has signed agreements with the GS issuer on the participation in GS auction , GS issuance (subscription) and (or) financial or investment services.

Other instruments related to Government borrowing on behalf of the State shall mean agreements entered into by the Ministry of Finance and the provider of financial services or other services related to Government borrowing on behalf of the State on financial derivatives and other instruments of Government borrowing on behalf of the State as well as on application of management instruments of obligations created by Government borrowing on behalf of the State, also contracts, agreements, confirmation letters and other documents necessary to ensure fulfilment of the obligations created by Government borrowing on behalf of the State (such as a fiscal agent agreement, paying agent agreement, process agent agreement, legal services contract etc.).

Euro Commercial Paper Programme of the Republic of Lithuania shall mean an instrument, approved by the Minister of Finance, falling within the category of other instruments related to Government borrowing on behalf of the State, which sets out the general terms governing subscription for Government euro commercial papers.

Early GS redemption auction shall mean an auction where the GS issuer offers investors an opportunity to redeem GS before maturity.

Early GS redemption shall mean repayment by the GS issuer of funds for the GS to investors through the intermediaries of public securities trading or its own authorised persons before maturity, and cancellation of the respective GS. Repayable funds consist of the nominal value of the GS or the nominal value plus interest, as specified in the terms of issuance, or the securities' value agreed upon by the GS issuer and investor, or such agreed value plus interest.

A State- or municipality-controlled enterprise shall correspond to its definition in the Rules for the collection, storage and submission to the European Commission of information on the financial relations of State or municipal authorities and State- or municipality-controlled enterprises as well as enterprises obliged to keep separate accounts, approved by Government Resolution No 768 of 14 July 2005 (Official Gazette, 2005, No 87-3264; 2007, No 135-5477).

Intermediary of public securities trading shall correspond to its definition on the Law of the Republic of Lithuania on Securities (2007, No 17-626; 2011, No 145-6819).

Government treasury bill shall mean a GS with a nominal maturity of up to one year.

Government euro commercial paper shall mean a short-term (one year maximum maturity) binding debt instrument subscribed for under the Euro Commercial Paper Programme of the Republic of Lithuania.

Government bond shall mean a GS with a nominal maturity longer than one year.

Government saving note shall mean retail GS.

Payment for GS shall mean the transfer of funds for the GS purchased by investors on the primary securities market to the GS issuer or its authorised person.

GS coupon payment shall mean interest on GS, paid by the GS issuer.

GS coupon period shall mean a period between two adjacent GS coupon payments.

GS coupon rate shall mean an annual rate of interest payable at specified intervals by the GS issuer to the investor, expressed as a percentage of the GS nominal value.

GS auctioneer shall mean a person, appointed by the GS issuer, that has technical capacities to organise GS distribution by auction and has signed an auction organisation services contract with the GS issuer.

GS issuer shall mean an institution offering or issuing GS. The GS issuer shall be the Government, represented by the Ministry of Finance.

Authorised person of the GS issuer shall mean a person selected by the GS issuer, other than an authorised intermediary of public securities trading, that has technical capacities to distribute GS to retail investors and has signed a GS distribution services contract with the GS issuer.

GS redemption shall mean repayment of funds for GS by the GS issuer to investors through intermediaries of public securities trading or its own authorised persons, upon maturity, and cancellation of the respective GS. Repayable funds shall consist of the nominal value of the GS or the nominal value plus interest, as specified in the terms of GS issuance.

GS issuance by auction shall mean a method of GS issuance whereby the GS issuer accepts and processes bids for GS on the primary securities market through a GS auctioneer, while the yield of the auctioned GS with pre-determined characteristics is established with regard to the yield identified in the bids for these securities received from authorised intermediaries of public securities trading (GS auction participants).

GS issuance by private placement shall mean a method of GS issuance whereby the GS issuer sells GS on the primary securities market under the procedure prescribed in the Rules to one or several authorised intermediaries of public securities trading who acquire, on their own behalf, the entire GS issue thus issued, while the securities characteristics and yield are determined by negotiations between the GS issuer and the authorised intermediaries of public securities trading.

Syndicated issuance of GS shall mean a method of GS issuance whereby the GS issuer accepts and executes bids for such securities on the primary securities market through generally several (or one) authorised intermediaries of public securities trading, while the GS characteristics and the yield are determined on the basis of the demand for them as well as the yield specified in the investors' bids for these securities.

Retail issuance of GS shall mean a method of GS issuance whereby the issuer sells GS of pre-determined characteristics and yield on the primary securities market through its authorised person or authorised intermediaries of public securities trading to all entities that have the right to invest in such securities.

3. To obtain the most economically advantageous borrowing terms, the Ministry of Finance:

3.1. with regard to the indicators set out in the Law of the Republic of Lithuania on the Approval of Financial Indicators of the State Budget and Municipal Budgets for the respective year, shall forecast the need for Government borrowing on behalf of the State for a current year;

3.2 shall select the borrowing methods set out in the Rules: GS issuance (under the procedure laid down in Section II of the Rules) or taking a loan and subscription for other binding debt instruments (under the procedure laid down in Chapter III of the Rules); shall plan GS issuance, taking loans or other binding debt instruments, the intended amounts to be borrowed under those instruments, the borrowing methods, terms and conditions; and shall ensure fulfilment of all of the State's financial obligations under the binding debt instruments;

3.3. with regard to the targets set in the Government Borrowing and Debt Management Guidelines for the respective year, the need for borrowing on behalf of the State as well as the condition and trends of the domestic and international financial markets as well as the effectiveness of various existing instruments of borrowing on behalf of the State, shall set the GS characteristics, the terms and conditions of issuance and the terms of redemption, and shall coordinate with creditors the conditions of subscription for other binding debt instruments and other instruments related to Government borrowing on behalf of the State;

3.4. In accordance with the procedure prescribed by the Minister of Finance, shall negotiate with potential providers of financial services. When selecting a provider of financial services, the Ministry of Finance shall request for proposals from least three financial service providers (except where the loan is taken from State- or municipality-controlled enterprises or foreign Governments, or a fiscal agent or payment agent is selected, or GS are issued by private placement); proposals shall be evaluated and the provider(s) of financial services selected under the procedure laid down by the Minister of Finance, taking into consideration the best price and the additional criteria set out by the Minister of Finance;

3.5. shall have the right to select a fiscal or payment agent, at the proposal of the financial service provider or at its own discretion, who shall perform the operations of issuance or settlement of other binding debt instruments subscribed for; the financial or payment agent may establish the procedure for carrying out these operations, with the approval of the Ministry of Finance.

I. PRIMARY TRADING IN GS

4. The Ministry of Finance shall issue GS, denominated in the euro or another currency, into primary market:

5. Decisions on the securities issue schedules, issuance, distribution and characteristics, determination of the terms of issuance, redemption and related questions shall be taken by the Ministry of Finance, with regard to the need for borrowing on behalf of the State, the strategy of borrowing on behalf of the State and other circumstances that the Ministry of Finance deems relevant.

6. In the case of GS issuance by auction, the Ministry of Finance shall, before the first business day of each month, publish a preliminary three-month auction schedule on its website and shall publish the terms of issuance of GS issued by auction no later than five business days before the auction date. This notice shall specify the following terms of issuance:

6.5. for GS with coupons:

7. The Ministry of Finance shall announce the issue volume or the yield or price limit (if it was decided to announce one of them in advance) on its website no later than one business day before the auction date.

8. When GS are issued by retail, the Ministry of Finance shall, before the first business day of each month, publish a preliminary three-month issue schedule for such GS, specifying the following conditions:

9. No later than one day prior to the start of the planned issue of such GS, the Ministry of Finance shall publish the terms of the GS issue, enumerated in paragraphs 6–8 of the Rules, on its website.

10. Primary distribution of GS shall be done as a private placement, if the Ministry of Finance, with regard to the condition and trends of the domestic and international financial markets, the amount to be borrowed, the interest rates and their trends at GS auctions, has determined, after questioning at least three authorised intermediaries of public securities trading, that:

10.1. borrowing the required amount for a specific period by auction, syndication or retail is impossible (none of the questioned authorised intermediaries of public securities trading has offered such borrowing possibilities) or such a possibility is very limited and may jeopardize the effectiveness of the pursued strategy for borrowing on behalf of the State; or

10.2. the cost of borrowing an equivalent amount of funds for a specific period using other instruments and methods of borrowing on behalf of the State (taking loans, distributing GS on the domestic (by methods other than private placement) or foreign markets or subscribing for other binding debt instruments) would be higher compared to the cost of GS issuance by private placement proposed by the authorised intermediaries of public securities trading.

11. In the case of GS issue by syndication or private placement, the following procedures shall apply:

11.1. after selecting the best offer (or several offers), the Minister of Finance or another Government-authorised person and the selected potential authorised intermediary(-ies) of public securities trading shall sign a contract by which the Minister of Finance or another Government-authorised person authorises the authorised intermediary(-ies) of public securities to organise GS issuance, and the expenditure related to GS issuance and documentation shall be approved;

11.2. in the case of issuance on foreign markets, at the request of the authorised intermediary(-ies) of public securities trading, the GS issuer shall prepare an offering circular (memorandum) on the Republic of Lithuania, intended for potential investors in the GS; the offering circular (memorandum) shall provide information on the political and financial situation in the Republic of Lithuania and specify the rights and responsibilities of investors or financial service providers and the GS issuer;

12. Decisions on GS issuance by private placement and the terms of the GS shall be adopted by the Ministry of Finance in line with paragraph 10 of the Rules.

13. The GS trading technical requirements and the technical conditions for GS issuance by auction, retail, syndication or private placement and for other operations in connection with putting GS into circulation shall be established by the Ministry of Finance.

131. The terms of a GS issue with a maturity longer than one year shall include the collective action clauses related to modification of the conditions of Government securities purchased by domestic or foreign creditors. These collective action clauses, set out in Annex 1 to the Rules, form an integral part of the terms of the GS issue.

14. A GS issue registration account with the depository shall be opened only after payment of the GS, unless the GS terms of issuance prescribe otherwise.

15. GS shall be issued in a nonmaterial form. GS shall be registered with Lithuanian or foreign depositories and recorded by entries in general and personal GS accounts. GS shall be included in the trading lists of regulated market operators at the request of the Ministry of Finance or its authorised person, unless the GS terms of issuance provide otherwise.

II. SECONDARY TRADING IN GS

17. Secondary GS trading may be carried out on the Lithuanian and foreign stock exchanges in accordance with the procedure prescribed by those exchanges and in line with the requirements applicable to secondary trading financial instruments laid down in the legislation, both in and outside the regulated market, unless the GS terms of issuance provide otherwise.

18. GS transactions taking place on regulated markets shall be settled in accordance with the procedure prescribed by the depository and the operators of those regulated markets. GS transactions taking place outside regulated markets shall be settled in accordance with the procedure prescribed by the depository if settlement under the transaction is made using the services of the securities settlement system or in the manner chosen by the parties to the transaction.

III. GS ACCOUNTING

19. The general accounting of the GS issue shall be done and the general GS accounts shall be managed by the public limited company Central Securities Depository of Lithuania or the depository of a foreign State (hereinafter together referred to as "depository").

IV. GS REDEMPTION AND PAYMENT OF INTEREST

22. The amounts of GS coupon payments and the payment dates shall be set and the accrued interest as well as the price shall be calculated under the methodology set out in Annex 2 to the Rules, except where the Ministry of Finance and the authorised intermediary(-ies) of public securities trading agree otherwise or the GS terms of issuance state otherwise.

23. Funds for redeemed GS and/or coupon payments shall be repaid to investors through the depository and account managers with which the investor holds a personal securities account for such GS.

24. The Ministry of Finance may carry out early redemption on the secondary GS market by way of an early redemption auction or through authorised intermediaries of public securities trading. The Ministry of Finance shall select a specific method for early redemption of GS taking into account the size of temporarily idle State financial resources, the factual collection of the State budget of the Republic of Lithuania, the need for borrowing on behalf of the State, the condition and trends of the financial markets, the current prospect of State financial resources and other factors.

26. When adopting a decision on an early redemption auction, the Ministry of Finance shall define its conditions that shall be published on the Ministry of Finance website at least five days prior to the scheduled auction. The Ministry of Finance shall announce the issue volume or the yield or price limit (if it was decided to announce one of them in advance) on its website no later than one business day before the auction date.

27. GS shall be redeemed and interest paid to those investors that own GS at the end of the last business day preceding the GS redemption or GS coupon payment. If the pre-scheduled GS redemption day does not coincide with a business day, GS shall be redeemed on the first business day following the non-business days.

28. The Ministry of Finance and the depository shall, according to the deadlines specified in the contract, agree upon the amounts of funds that will have to be transferred to the account specified by the depository on the day of GS redemption or GS coupon payment and further paid out to investors via the accounts of the intermediaries of public securities trading representing them.

29. The Ministry of Finance or its authorised person shall transfer funds to the account specified by the depository at least two hours before the moment when the intermediaries of public securities trading or the persons authorised by the Ministry of Finance have to settle the GS.

30. Intermediaries of public securities trading shall repay the funds due to their clients on the day of GS redemption or on the day of GS coupon payment, unless their contracts with the clients provide otherwise.

The Ministry of Finance, its authorised person or the depository shall not be responsible for any default on the part of the intermediaries of public securities trading.

31. If the GS redemption date has expired and the investor has not claimed the invested funds that belong to it in time, the investor shall be entitled to the invested funds that belong to it in accordance with the procedure prescribed by the Civil Code of the Republic of Lithuania (Official Gazette, 2000, No 74-2262) and other legislation governing GS issue, trading and redemption. The GS issuer shall not calculate or pay interest on any funds that were not claimed in time, or were not received in time through the fault of a person other than the GS issuer.

III. TAKING LOANS ON BEHALF OF THE STATE AND SUBSCRIPTION FOR OTHER BINDING DEBT INSTRUMENTS AND OTHER INSTRUMENTS RELATING TO GOVERNMENT BORROWING ON BEHALF OF THE STATE

32. When planning to take a loan on behalf of the State, the Ministry of Finance shall apply to potential loan providers in accordance with the procedure prescribed by paragraph 3.4 of the Rules, requesting written proposals on lending possibilities.

33. The Ministry of Finance can borrow from State or municipality-controlled enterprises and foreign State governments without observing the requirements laid down in paragraph 32 of the Rules.

34. When planning borrowing on behalf of the State by way of subscribing for Government euro commercial papers, the Ministry of Finance:

34.1. following the procedure laid down in paragraph 3.4 of the Rules, shall choose a financial service provider that will draft the Euro Commercial Paper Programme of the Republic of Lithuania as well as other financial service providers under this programme; and/or

34.2. in case a Euro Commercial Paper Programme of the Republic of Lithuania already exists and the financial service provider(s) that will implement this programme has (have) already been selected, shall apply to the selected financial service provider(s) that will implement the programme and that has (have) signed programme implementation contracts with the Ministry of Finance with a request for written proposals on the possibilities of subscribing for Government euro commercial papers; the proposals shall be evaluated under the procedure set by the Minister of Finance, with regard to the proposed lowest yield of Government euro commercial papers.

35. The Euro Commercial Paper Programme of the Republic of Lithuania shall set out the general conditions for subscription to Government euro commercial papers, i.e. specify the maximum amount of Government euro commercial papers in circulation at a time, the procedure for subscription, the applicable restrictions, the financial service providers under the programme and other conditions.

36. At the time of subscription for Government euro commercial papers, the yield of the Government euro commercial papers agreed upon with investors and other conditions of subscription for Government euro commercial papers shall be fixed in the confirmation letter of Government euro commercial papers signed by the Minister of Finance or another Government-authorised person.

Annex 1 to the Rules for the issuance and trading of securities of the Government of the Republic of Lithuania, borrowing on behalf of the State and subscription for other binding debt instruments

TERMS OF REFERENCE FOR COLLECTIVE ACTION RELATED TO MODIFICATION OF THE TERMS OF AN ISSUE (ISSUES) OF THE SECURITIES OF THE GOVERNMENT OF THE REPUBLIC OF LITHUANIA

TERMS OF REFERENCE

1. The Terms of Reference for collective action related to modification of the terms of an issue (issues) of the securities of the Government of the Republic of Lithuania (hereinafter referred to as "the Terms of Reference") shall form an integral part of the Government securities issue of all Member States of the euro area. The Terms of Reference set out the general conditions governing collective action by domestic or foreign creditors having acquired securities of the Government of the Republic of Lithuania (hereinafter – "security") related to modification of the terms of a securities issue (issues) or agreement governing the issuance and administration of the securities (hereinafter referred to as "agreement"), and specify the cases and the procedure of applying these conditions.

2. Definitions for the purposes of the Terms of Reference:

2.1. Reserved matter modification shall mean a modification of the terms and conditions of the securities or of any agreement that would:

2.1.4. reduce the securities redemption price or change any date on which the securities may be redeemed[1];

2.1.6. impose any condition or otherwise modify the issuer's obligation to make payments on the securities;

2.1.7. release any guarantee issued in relation to the securities or change the terms of that guarantee, except in permissible cases[2];

2.1.8. release any collateral that is pledged or charged as security for the payment of the securities or change the terms on which that collateral is pledged or charged[3];

2.1.9. change the payment-related circumstance under which the securities may be declared due and payable prior to their stated maturity[4];

2.1.12. change any court whose jurisdiction the issuer has submitted or any immunity waived by the issuer in relation to legal proceedings arising out of or in connection with the securities[6];

2.1.13. change the principal amount of outstanding securities or, in the case of a cross-series modification, the principal amount of the debt securities of any another series required to approve a proposed modification in relation to the securities, the principal amount of outstanding securities required for a quorum to be present, or the rules for determining whether a security is outstanding for these purposes;

2.1.14. change of the definition of "reserved matter modification" under paragraph 2.1 of the Terms of Reference.

The definition also covers debt securities of any other series on condition that any of the foregoing references to the securities or any agreement shall be read as references to such other debt securities or any agreement governing the issuance or administration of such other debt securities.

2.2. Securities holder record date (hereinafter referred to as "record date") in relation to any proposed modification shall mean the date fixed by the issuer for specifying the securities holder or, in the case of a cross-series modification, the holders of debt securities of each other series that are entitled to vote on or sign a written resolution in relation to the proposed modification.

2.3. Cross-series modification of debt securities (hereinafter referred to as "cross-series modification") shall mean a modification involving securities or any agreement and the debt securities of one or more other series or any agreement governing the issuance or administration of such other debt securities.

2.4. Outstanding debt security shall mean any debt security that is outstanding for the purposes of paragraph 11 of the Terms of Reference.

2.5. Outstanding security shall mean any security that is outstanding for the purposes of paragraph 10 of the Terms of Reference.

2.6. Zero-coupon security shall mean a debt security that does not expressly provide for the accrual of interest, and includes the former component parts of a debt security that did expressly provide for the accrual of interest if that component part does not itself expressly provide for the accrual of interest.

2.7. Modification shall mean any modification, amendment, supplement or waiver of the terms and conditions of the securities or any agreement. The definition also covers debt securities of any other series on condition that any of the foregoing references to the securities or any agreement shall be read as references to such other debt securities or any agreement governing the issuance or administration of such other debt securities.

2.8. Debt security holder shall mean the person the issuer is entitled to treat as the legal holder of the security under the law governing that debt security.

2.9. Debt security shall mean a security, including bills, bonds, debentures, notes or other debt securities, issued by the issuer in one or more series with an original stated maturity of more than one year, and shall include any such obligation, irrespective of its original stated maturity, that formerly constituted a component part of a debt security.

2.10. Debt securities series (hereinafter referred to as "series") shall mean a tranche of debt securities, together with any further tranche or tranches of debt securities that in relation to each other and to the original tranche of debt securities are identical in all respects except for their date of issuance or first payment date, and expressed to be consolidated and form a single series, and includes the securities and any further issuances of such securities.

2.11. Index-linked securities means a debt security that provides for the payment of additional amounts linked to changes in a published index (of stocks, commodities, exchange etc.), but does not include a component part of an index-linked security that is no longer attached to that index-linked security.

RESERVED MATTER MODIFICATION

3. The terms and conditions of the securities and agreement may be modified in relation to a reserved matter with the consent of the issuer and:

3.1. the affirmative vote of holders of not less than 75 % of the aggregate principal amount of the outstanding securities represented at a duly called meeting of securities holders; or

CROSS-SECTION MODIFICATION

4. In the case of a cross-series modification, the terms and conditions of securities and debt securities of any other series, and of any agreement may be modified in relation to a reserved matter with the consent of the issuer and:

4.1. the affirmative vote of not less than 75% of the aggregate principal amount of the outstanding debt securities represented at separate duly called meetings of the holders of the debt securities of all the series (taken in the aggregate) that would be affected by the proposed modification; or

4.2. a written resolution signed by or on behalf of the holders of not less than 66 2/3% of the aggregate principal amount of the outstanding debt securities of all the series (taken in the aggregate) that would be affected by the proposed modification; and

4.3. the affirmative vote of more than 66 2/3% of the aggregate principal amount of the outstanding debt securities represented at separate duly called meetings of the holders of each series of debt securities (taken individually) that would be affected by the proposed modification; or

PROPOSED CROSS-SECTION MODIFICATION

6. A proposed cross-series modification may include one or more proposed alternative modifications of the terms and conditions of each affected series of debt securities or of any agreement, provided that all such proposed alternative modifications are addressed to and may be accepted by any holder of any debt security of any affected series.

PARTIAL CROSS-SECTION MODIFICATION

7. If a proposed cross-series modification is not approved in relation to a reserved matter in accordance with paragraph 4 of the Terms of Reference, but would have been so approved if the proposed modification had involved only the securities and one or more, but less than all, of the other series of debt securities affected by the proposed modification, that cross-series modification shall be deemed to have been approved, notwithstanding paragraph 4 of the Terms of Reference, in relation to the securities and debt securities of each other series whose modification would have been approved in accordance with paragraph 4 of the Terms of Reference if the proposed modification had involved only the securities and debt securities of such other series, provided that:

7.1. prior to the record date for the proposed cross-series modification, the issuer has publicly notified holders of the securities and other affected debt securities of the conditions under which the proposed cross-series modification shall be deemed to have been approved if it is approved in the manner described above in relation to the securities and some but not all of the other affected series of debt securities; and

MODIFICATION OF THE TERMS OF A SECURITIES ISSUE UNRELATED TO A RESEVED MATTER MODIFICATION

8. The terms and conditions of securities and any agreement may be modified in relation to any matter other than a reserved matter with the consent of issuer and:

8.1. the affirmative vote of holders of more than 50% of the aggregate principal amount of the outstanding securities represented at a duly called meeting of securities holders; or

PECULIARITIES OF MODIFICATION OF THE CONDITIONS OF MULTIPLE CURRENCY, INDEX-LINKED AND ZERO-COUPON SECURITIES ISSUES

9. In determining whether a proposed modification has been approved by the requisite principal amount of securities and debt securities of one or more other series:

9.1. if the modification involves debt securities denominated in more than one currency, the principal amount of each affected debt security shall be equal to the amount of euro that could have been obtained on the record date for the proposed modification with the principal amount of that debt security, using the applicable euro foreign exchange reference rate for the record date published by the European Central Bank;

9.2. if the modification involves an index-linked security, the principal amount of each such index-linked security shall be equal to its adjusted principal amount;

9.3. if the modification involves a zero-coupon security that did not formerly constitute a component part of an index-linked security, the principal amount of each such zero-coupon security shall be equal to its nominal amount or, if its stated maturity date has not yet occurred, to the present value of its nominal amount;

9.4. if the modification involves a zero-coupon security that formerly constituted a component part of an index-linked security, the principal amount of each such zero-coupon security that formerly constituted the right to receive:

9.4.1. a non-index-linked payment of principal or interest that shall be equal to its nominal amount or, if the stated maturity date of the non-index-linked payment has not yet occurred, to the present value of its nominal amount;

9.5. for purposes of paragraph 9 of the Terms of Reference:

9.5.1. the adjusted nominal amount of any index-linked security and any component part of an index-linked security is the amount of the payment that would be due on the stated maturity date of that index-linked security or component part if its stated maturity date was the record date for the proposed modification, based on the value of the related index on the record date published by or on behalf of the issuer or, if there is no such published value, on the interpolated value of the related index on the record date determined in accordance with the terms and conditions of the index-linked security, but in no event will the adjusted nominal amount of such index-linked security or component part be less than its nominal amount, unless the terms and conditions of the index-linked security provide that the amount of the payment made on such index-linked security or component part may be less than its nominal amount;

9.5.2. the present value of a zero-coupon security is determined by discounting the nominal amount (or the adjusted nominal amount) of that zero-coupon security from its stated maturity date to the record date at the specified discount rate using the applicable market day-count convention, where the specified discount rate is:

9.5.2.1. if the zero-coupon security was not formerly a component part of a debt security that expressly provided for the accrual of interest, the yield to maturity of that zero-coupon security at issuance or, if more than one tranche of that zero-coupon security has been issued, the yield to maturity of that zero-coupon security at the arithmetic average of all the issue prices of all the zero-coupon securities of that series of zero-coupon securities weighted by their nominal amounts;

9.5.2.2. if the zero-coupon security was formerly a component part of a debt security that expressly provided for the accrual of interest:

9.5.2.2.2. if such debt security cannot be identified, the arithmetic average of all the coupons on all of the issuer’s debt securities (weighted by their principal amounts) referred to below that have the same stated maturity date as the zero-coupon security to be discounted, or, if there is no such debt security, the coupon interpolated for these purposes on a linear basis using all of the issuer’s debt securities (weighted by their principal amounts) referred to below that have the two closest maturity dates to the maturity date of the zero-coupon security to be discounted, where the debt securities to be used for this purpose are all of the issuer’s index-linked securities if the zero-coupon security to be discounted was formerly a component part of an index-linked security and all of the issuer’s debt securities (index-linked securities and zero-coupon securities excepted) if the zero-coupon security to be discounted was not formerly a component part of an index-linked security, and in either case are denominated in the same currency as the zero-coupon security to be discounted.

OUTSTANDING SECURITIES

10. In determining whether holders of the requisite nominal amount of outstanding securities have voted in favour of a proposed modification or whether a quorum is present at any meeting of security holders called to vote on a proposed modification, a security shall be deemed to be not outstanding, and may not be voted for or against a proposed modification or counted in determining whether a quorum is present, if on the record date for the proposed modification:

10.1. the security has previously been cancelled or delivered for cancellation or held for reissuance but not reissued;

10.2. the security has previously been called for redemption in accordance with its terms or previously become due and payable at maturity or otherwise and the issuer has previously satisfied its obligation to make all payments due in respect of the security in accordance with its terms[10]; or

10.3. the security is held by the issuer, the issuer's State institution or agency or a structural unit thereof or another legal entity and, in the case of a security held by any such above-mentioned legal entity, the holder of the security does not have autonomy of decision, where:

10.3.1. the holder of a security for these purposes is the entity legally entitled to vote for or against a proposed modification or the entity whose consent or instruction is by contract required, directly or indirectly, for the legally entitled holder to vote for or against a proposed modification;

10.3.2. another legal entity is controlled by the issuer or by the issuer's State institution or agency or a structural unit thereof, if the issuer or the issuer's State institution or agency, or a structural unit thereof, has the power, directly or indirectly, through the ownership of voting securities or other ownership interests, by contract or otherwise, to direct the management of or elect or appoint a majority of the board of directors or other persons performing similar functions affecting ownership, or even the board of directors of that legal entity; and

10.3.3. the holder of a security has autonomy of decision if, under applicable law, rules or regulations and independent of any direct or indirect obligation, the holder may have in relation to the issuer:

10.3.3.1. the holder may not, directly or indirectly, take instruction from the issuer on how to vote on a proposed modification; or

10.3.3.2. the holder, in determining how to vote on a proposed modification, is required to act in accordance with an objective prudential standard, in the interest of all of its stakeholders or in the holder’s own interest; or

10.3.3.3. the holder owes a fiduciary or similar duty to vote on a proposed modification in the interest of one or more persons other than a person whose holdings of securities (if that person then held any securities) would be deemed to be not outstanding under paragraph 10 of the Terms of Reference.

OUTSTANDING DEBT SECURITIES

11. In determining whether holders of the requisite principal amount of outstanding debt securities of another series have voted in favour of a proposed cross-series modification or whether a quorum is present at any meeting of the holders of such debt securities called to vote on a proposed cross-series modification, an affected debt security shall be deemed to be not outstanding, and may not be voted for or against a proposed cross-series modification or counted in determining whether a quorum is present, in accordance with the applicable terms and conditions of that debt security.

ENTITIES NOT HAVING AUTONOMY OF DECISION

12. For transparency purposes, the issuer shall publish promptly following the issuer’s formal announcement of any proposed modification of the securities, but in no event less than 10 days prior to the record date for the proposed modification, a list identifying each legal entity that for purposes of subparagraph 10.3 of the Terms of Reference:

12.1. is controlled by the issuer or by a State institution or body, or a structural unit thereof, of the issuer;

12.2. has in response to an enquiry from the issuer reported to the issuer that it was at that moment the holder of one or more securities; and

EXCHANGE OF SECURITIES OR CONVERSION THEREOF INTO NEW SECURITIES

13. Any duly approved modification of the terms and conditions of the securities may be implemented by means of a mandatory exchange or conversion of the securities for new debt securities containing the modified terms and conditions if the proposed exchange or conversion is notified to the securities holders prior to the record date for the proposed modification. Any conversion or exchange undertaken to implement a duly approved modification shall be binding on all securities holders.

TECHNICAL AMENDMENTS

14. Notwithstanding anything to the contrary herein, the terms and conditions of the securities or any agreement may be modified by the issuer without the consent of securities holders:

APPOINTMENT OF THE CALCULATION AGENT

16. The issuer shall appoint a person (calculation agent) to calculate whether a proposed modification has been approved by the requisite principal amount of outstanding securities and, in the case of a cross-series modification, by the requisite principal amount of outstanding debt securities of each affected series of debt securities. In the case of a cross-series modification, the same person shall be appointed as the calculation agent for the proposed modification of the securities and each other affected series of debt securities.

17. The issuer shall provide to the calculation agent and publish prior to the date of any meeting called to vote on a proposed modification or the date fixed by the issuer for the signing of a written resolution in relation to a proposed modification, a certificate, which, pursuant to the provisions of paragraph 9 of the Terms of Reference, where applicable, shall specify:

17.1. the total principal amount of securities and, in the case of a cross-series modification, debt securities of each other affected series outstanding on the record date for purposes of paragraph 10 of the Terms of Reference;

17.2. the total principal amount of securities and, in the case of a cross-series modification, debt securities of each other affected series that are deemed under subparagraph 10.3 of the Terms of Reference to be not outstanding on the record date; and

18. The calculation agent may rely on any information contained in the certificate provided by the issuer, and that information shall be conclusive and binding on the issuer and the securities holders unless:

18.1. an affected securities holder delivers a substantiated written objection to the issuer in relation to the certificate before the vote on a proposed modification or a signed written resolution in relation to a proposed modification; and

19. In the event a substantiated written objection is timely delivered, any information relied on by the calculation agent will nonetheless be conclusive and binding on the issuer and affected securities holders if:

19.2. the securities holder that delivered the objection does not commence legal action in respect of the objection before a court whose jurisdiction covers the issuer within 15 days of the publication of the results of the vote taken or the written resolution signed in relation to the proposed modification; or

20. The issuer shall arrange for the publication of the results of the calculations made by the calculation agent in relation to a proposed modification promptly following the meeting called to consider that modification or, if applicable, the date fixed by the issuer for signing a written resolution in respect of that modification.

MEETINGS OF SECURITIES HOLDERS; WRITTEN RESOLUTIONS

21. The provisions set out below, and any additional rules adopted and published by the issuer shall, to the extent consistent with the provisions set out below, apply to any meeting of securities holders called to vote on a proposed modification and to any written resolution adopted in connection with a proposed modification. Any action contemplated in Chapter IV of the Terms of Reference to be taken by the issuer may instead be taken by an agent acting on behalf of the issuer.

22. A meeting of securities holders:

22.2. shall be convened by the issuer if an event of default in relation to the securities has occurred and is continuing and a meeting is requested in writing by the holders of not less than 10% of the aggregate principal amount of the securities then outstanding[11].

23. The notice convening a meeting of securities holders shall be published by the issuer at least 21 days prior to the date of the meeting or, in the case of an adjourned meeting, at least 14 days prior to the date of the adjourned meeting. The notice shall:

23.2. set out the agenda and quorum for, and the text of any resolutions proposed to be adopted at, the meeting;

23.3. specify the record date for the meeting, being not more than five business days[12] before the date of the meeting, and the documents required to be produced by a securities holder in order to be entitled to participate in the meeting;

23.4. include the form of instrument to be used to appoint a proxy to act on a securities holder's behalf;

23.5. set out any additional rules adopted by the issuer for the convening and holding of the meeting and, if applicable, the conditions under which a cross-series modification shall be deemed to have been satisfied if it is approved as to some but not all of the affected series of debt securities;

24. The chair of any meeting of securities holders shall be appointed:

25. No business shall be transacted at any meeting in the absence of a quorum other than the choosing of a chair if one has not been appointed by the issuer. The quorum at any meeting at which securities holders will vote on a proposed modification of:

25.1. a reserved matter shall be one or more persons present and holding not less than 66 2/3% of the aggregate principal amount of the securities then outstanding;

26. If a quorum is not present within 30 minutes of the time appointed for a meeting, the meeting may be adjourned for a period of not more than 42 days and not less than 14 days as determined by the chair of the meeting. The quorum for any adjourned meeting shall be one or more persons present and holding:

26.1. not less than 66 2/3% of the aggregate principal amount of the securities then outstanding in the case of a proposed reserved-matter modification;

27. A written resolution signed by or on behalf of holders of the requisite majority of the securities shall be valid for all purposes as if it was a resolution passed at a meeting of securities holders duly convened and held in accordance with the Terms of Reference. A written resolution may be set out in one or more document in like form each signed by or on behalf of one or more securities holders.

28. Any person who is a holder of an outstanding security on the record date for a proposed modification, and any person duly appointed as a proxy by a holder of an outstanding security on the record date for a proposed modification, shall be entitled to vote on the proposed modification at a meeting of securities holders and to sign a written resolution with respect to the proposed modification.

29. Every proposed modification shall be submitted to a vote of the holders of outstanding securities represented at a duly called meeting or to a vote of the holders of all outstanding securities by means of a written resolution without need for a meeting A securities holder may cast votes on each proposed modification equal in number to the principal amount of the holder’s outstanding securities:

29.1. in the case of a cross-series modification involving debt securities denominated in more than one currency, the principal amount of each debt security shall be determined in accordance with subparagraph 9.1 of the Terms of Reference;

29.2. in the case of a cross-series modification involving an index-linked security, the principal amount of each such index-linked security shall be determined in accordance with subparagraph 9.2 of the Terms of Reference;

29.3. in the case of a cross-series modification involving a zero-coupon security that did not formerly constitute a component part of an index-linked security, the principal amount of each such zero-coupon security shall be determined in accordance with subparagraph 9.3 of the Terms of Reference;

30. Each holder of an outstanding security may, by an instrument in writing executed on behalf of the holder and delivered to the issuer not less than 48 hours before the time fixed for a meeting of securities holders or the signing of a written resolution, appoint any person (proxy) to act on the holder's behalf in any meeting of securities holders at which the holder is entitled to vote or to sign any written resolution that the holder is entitled to sign. Appointment of a proxy pursuant to any form other than the form enclosed with the notice of the meeting shall not be valid for these purposes.

31. A proxy duly appointed in accordance with the above provisions shall, subject to paragraph 10 of the Terms of Reference and for so long as that appointment remains in force, be deemed to be (and the person who appointed that proxy shall be deemed not to be) the holder of the securities to which that appointment relates, and any vote cast by a proxy shall be valid notwithstanding the prior revocation or amendment of the appointment of that proxy unless the issuer has received notice or has otherwise been informed of the revocation or amendment at least 48 hours before the time fixed for the commencement of the meeting at which the proxy intends to cast its vote or, if applicable, the signing of a written resolution.

32. A resolution duly passed at a meeting of securities holders convened and held in accordance with these provisions, and a written resolution duly signed by the requisite majority of securities holders, shall be binding on all securities holders, whether or not the holder was present at the meeting, voted for or against the resolution or signed the written resolution.

PUBLICATION OF NOTICES

34. The issuer shall publish all notices and other information required to be published in the cases and in accordance with the procedure specified in the Terms of Reference:

34.2. in the settlement system of the public limited company Central Securities Depository of Lithuania[13];

FINAL PROVISIONS

35. In the case of continuing default on any obligations specified in the terms of the securities issue or agreement, the holders of no less than 25% of the aggregate principal amount of outstanding securities may, by written notice given to the issuer, declare the securities to be immediately due and redeemable[14]. If a declaration of acceleration is properly given in accordance with the present paragraph, all amounts payable on the securities become immediately due and payable on the date that a written notice of acceleration is received by the issuer, unless the default is resolved or withdrawn prior to the receipt of the notice by the issuer.

36. Holders of more than 50% of the aggregate principal value of outstanding securities may, on behalf of all the holders of the securities, rescind or annul any notice of acceleration submitted under paragraph 35 of the Terms of Reference.

37. No securities holder will be entitled to institute legal proceedings against the issuer or take steps to enforce the rights of the securities holders under the terms and conditions of the securities, unless the trustee or fiscal agent, having become bound to proceed in accordance with these terms and conditions, has failed to do so within a reasonable time and this situation continues[15].

Annex 2 to the Rules for the issuance and trading of securities of the Government of the Republic of Lithuania, borrowing on behalf of the State and subscription for other binding debt instruments

PROCEDURE FOR DETERMINING GS COUPON PAYMENT AMOUNTS AND PAYMENT DATES AND FOR THE CALCULATION OF THE ACCRUED INTEREST AND PRICE

I. GS COUPON PAYMENTS

2. The coupon rate shall be fixed by rounding down to one decimal place for GS distributed domestically and to three decimal places for GS distributed on a foreign market.

3. If the entire GS tenor contains several GS coupon payments, the following payment dates shall apply:

3.1. the respective day of the respective month of the year (for instance, in the case of GS for which the interest is due twice a year and which must be paid or redeemed on September 15, the GS coupon payment dates will be March 15 and September 15 each year);

5. The pre-scheduled GS coupon payment dates shall be nominal: if the scheduled date does not coincide with a business day, payment shall be due on the first business day following the non-business days.

6. GS coupon periods (except the first and the last ones) must be equal in tenor and may only differ due to different numbers of days in a month or year or an indivisible number of days in a year.

7. Interest shall be paid in equal parts for GS coupon periods of the same tenor, whether or not the nominal day of GS coupon payment coincides with a business day (for instance, 5 units (in the currency of GS denomination) will be paid semi-annually for every GS with a nominal value of 100 units (in the currency of GS denomination), the GS coupon rate of 10% and the payment frequency of two times a year).

8. In case of a non-standard length of the first or the last coupon periods, interest shall be paid for the actual number of days in that period, assuming that the year has p x H days (where p is the number of days in a standard period and H represents the number of GS coupon payments per year).

Example. The date of payment of GS is 5 April 20X1, the redemption date is 15 March 20X3, the GS coupon payment dates are March 15 and September 15, the nominal value of one security is 100 units in the currency of GS denomination, the GS coupon rate is 8% and the frequency of GS payments is twice a year. The first GS coupon period from 5 April 20X1 to 15 September 20X1 is a short one, equalling 163 days. Under this example, in the case of a standard period, where the GS payment day is 15 March 20X1, the GS coupon period will last 184 days. When making the first GS coupon payment, the amount of interest paid for one GS will be equal to 100 x 8 : 100 x 163 : (2 x 184) = 100 x 0.08 x 163 : 368 = 3.54 units of currency in which the GS were denominated.

Where the first GS coupon period is longer than the standard one, interest for the first part of the period shall be calculated as for the short period, while interest for the second period shall be calculated as for the standard period.

Example. The date of payment of the issued GS is 5 March 20X1, the redemption date is 15 March 20X3, the GS coupon payment dates are March 15 and September 15, the first GS coupon payment is on 15 September 20X1; when calculating the interest amount, the period is divided into 2 parts: from the payment date to the date of the missed GS coupon payment (March 5–15, 20X1) and from the date of the missed GS coupon payment to the first date of GS coupon payment (March 15 to September 15, 20X1).

If the GS issues were made prior to 30 June 20X1, the amount of interest paid when making the GS coupon payment for each GS shall be rounded of to two decimal places. If the GS issues were made after 1 July 20X1, the GS coupon payment for a single GS shall not be rounded off. The amount of the GS coupon payment transferred by the Ministry of Finance or its authorised person shall be distributed by the intermediaries of public securities trading to their clients in proportion to their GS holdings. The final amount of the GS coupon payment to an individual client shall be rounded down to a whole cent. Following this rounding, the remaining funds shall be distributed by the intermediaries of public securities trading to the client with the largest fractional residue, one cent each.

II. CALCULATION OF ACCRUED INTEREST

9. The total GS price consists of the clean price plus the accrued interest. The amount of money due to the seller for GS sold on the secondary securities market shall be equal to the clean price of the GS plus the interest accrued from the date of paying up or the nominal date of the last GS coupon payment to the date of settlement of the completed transaction.

10. All future GS coupon payments, beginning with the nearest one, are due to the seller. Where the settlement date coincides with the GS coupon payment date, the next payment shall be treated as the nearest GS coupon payment.

11. Interest shall accrue from the nominal date of GS payment or payment of the last GS coupon preceding the transaction day (inclusive) to the date of settlement of the GS (not inclusive). Calculation of the accrued interest relies on the assumption that GS coupon payment is made on the nominal date even where it is a non-business day and the actual payment is postponed under paragraph 5 of this Annex.

12. The accrued interest shall be calculated in respect of an exact number of days from the date of GS payment or the last GS coupon payment to the date of settlement of the GS, and a year shall be assumed to have p x H days.

Example. If the nominal value of a GS is 100 units (in the currency of GS denomination), the GS coupon rate is 8%, the frequency of coupon payments is twice a year, 90 days have passed from the last GS coupon payment date to the settlement date and the current coupon period is 181 days, the amount of interest accrued for 1 000 GS will be equal to 1 000 x 100 x 8/100 x 90/(2 x 181) = 1 000 x 100 x 0,08 x 90/362 = 1 988.95 units of the currency in which the GS were denominated.

III. CALCULATION OF THE PRICE OF SECURITIES

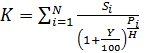

13. The following equation is recommended for calculating the price of Government bonds:

, where:

, where:

K – the total price of Government bonds (calculated for the nominal value of one Government bond in the currency of GS denomination);

Si – ith cash flow for the nominal value of one Government bond in the currency of GS denomination (interest amount or amount payable at redemption);

Y – yield;

H – the number of GS coupon payments per year (where Government bonds have no coupons, this number is assumed to coincide with the normal number of GS coupon payments for other Government bonds);

N – the number of GS coupon payments remaining until the redemption of the Government bond (for bonds without coupons, the assumed number of GS coupon payments);

Pi – the number of GS coupon periods from the date of payment of Government bonds or settlement of purchased Government bonds to the date of the ith cash flow payment (may be a fraction). In the event of non-standard coupon periods of a Government bond, estimation shall be made as to how many GS coupon periods there would be if all the maturities were of a standard length.

14. The following equation is recommended for calculating the price of Government treasury bills:

![]() , where

, where

K – the total price of a Government treasury bill (calculated for the nominal value of one Government treasury bill in the currency of GS denomination);

Y – yield;

d – the number of days from the date of payment of Government treasury bills or settlement of purchased Government treasury bills to the nominal date of redemption.